Market For Hard Drives and Other Storage Devices Expands

Shipments of storage devices for computers rose across the board during the second quarter, resulting from the March earthquake in Japan after panicked manufacturers strove to replenish stockpiles, according to a new IHS iSuppli analysis.

Combined shipments in the second quarter for the three major storage segments of hard disk drives (HDD), optical disk drives (ODD) and solid state drives (SDD) amounted to 248.8 million units, up 4.5 percent from 238.1 million units in the previous quarter, the research firm said. Second-quarter shipments also climbed 5.6 percent from the 235.5 million units shipped during the same time last year.

"In an ironic twist, the earthquake disaster in Japan had the effect of stimulating the storage market, as manufacturers accelerated orders and increased inventory to ensure adequate supply," said Fang Zhang, analyst for storage systems at IHS. "The effect was felt most in the HDD space, the largest storage segment, resulting in higher HDD shipments."

In all, HDD shipments during the second quarter amounted to 167.1 million units, up 4.2 percent from 160.4 million in the first quarter.

The HDD industry, however, faced challenges on the profitability front with margin declines suffered by Seagate Technology and Western Digital Corp., the two main players in the space. Forces contributing to a decline in profitability included price erosion resulting from higher competition; elevated research and development costs coming from technical issues associated with next-generation drives with higher densities; and the mounting cost of materials, such as rare-earth metals from China.

In the second largest storage segment, ODDs, shipments rose approximately 4.4 percent to 78.3 million units, but revenue was flat because of declining prices. Despite the growth, some computer original equipment manufacturers are abandoning ODDs?such as DVD ROMs and Blu-ray disc players or recorders?in certain PCs because of the ongoing transition from disc-based usage to streaming media, as well as the popularity of thin-type PCs like the MacBook Air from Apple Inc. that eschew ODDs altogether.

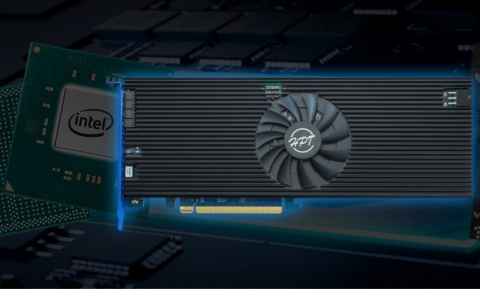

In the third storage segment of SSDs, shipments in the second quarter climbed a hefty 21.4 percent to 3.4 million units, up from 2.8 million in the first quarter. As the newest storage sector, SSDs continue to deepen their penetration into the market, and the technology is expected to pick up more steam with the recent debut of consumer NAND caching technology from Intel Corp.

Companion cache SSDs represent an easier and less expensive means to boost system performance compared to replacing HDDs, as caching requires less NAND and works alongside the hard disk drive.

The technology also addresses common customer and manufacturer complaints associated with standalone SSDs, including high average selling prices and limited densities.

However, the expected proliferation of cache SSDs in emerging end markets like the Ultrabook?a type of ultraportable laptop?will lower the industry?s average densities and pricing in the upcoming years, IHS projects, especially impacting the smaller participants of the SSD landscape.

The SSD market also faces the challenge of a crowded manufacturer base weighed down by a relative lack of experience. In particular, overreliance on third-party controllers and NAND flash sourced from the spot market contributed to a recent spate of drive errors and recalls.

Like any fast-growing semiconductor segment, SSDs are experiencing teething pains on the way to becoming a stable market with healthy revenues and margins. A thinning of the supplier base, however, will be necessary in order for SSDs to experience more sustainable dynamics, IHS believes.

"In an ironic twist, the earthquake disaster in Japan had the effect of stimulating the storage market, as manufacturers accelerated orders and increased inventory to ensure adequate supply," said Fang Zhang, analyst for storage systems at IHS. "The effect was felt most in the HDD space, the largest storage segment, resulting in higher HDD shipments."

In all, HDD shipments during the second quarter amounted to 167.1 million units, up 4.2 percent from 160.4 million in the first quarter.

The HDD industry, however, faced challenges on the profitability front with margin declines suffered by Seagate Technology and Western Digital Corp., the two main players in the space. Forces contributing to a decline in profitability included price erosion resulting from higher competition; elevated research and development costs coming from technical issues associated with next-generation drives with higher densities; and the mounting cost of materials, such as rare-earth metals from China.

In the second largest storage segment, ODDs, shipments rose approximately 4.4 percent to 78.3 million units, but revenue was flat because of declining prices. Despite the growth, some computer original equipment manufacturers are abandoning ODDs?such as DVD ROMs and Blu-ray disc players or recorders?in certain PCs because of the ongoing transition from disc-based usage to streaming media, as well as the popularity of thin-type PCs like the MacBook Air from Apple Inc. that eschew ODDs altogether.

In the third storage segment of SSDs, shipments in the second quarter climbed a hefty 21.4 percent to 3.4 million units, up from 2.8 million in the first quarter. As the newest storage sector, SSDs continue to deepen their penetration into the market, and the technology is expected to pick up more steam with the recent debut of consumer NAND caching technology from Intel Corp.

Companion cache SSDs represent an easier and less expensive means to boost system performance compared to replacing HDDs, as caching requires less NAND and works alongside the hard disk drive.

The technology also addresses common customer and manufacturer complaints associated with standalone SSDs, including high average selling prices and limited densities.

However, the expected proliferation of cache SSDs in emerging end markets like the Ultrabook?a type of ultraportable laptop?will lower the industry?s average densities and pricing in the upcoming years, IHS projects, especially impacting the smaller participants of the SSD landscape.

The SSD market also faces the challenge of a crowded manufacturer base weighed down by a relative lack of experience. In particular, overreliance on third-party controllers and NAND flash sourced from the spot market contributed to a recent spate of drive errors and recalls.

Like any fast-growing semiconductor segment, SSDs are experiencing teething pains on the way to becoming a stable market with healthy revenues and margins. A thinning of the supplier base, however, will be necessary in order for SSDs to experience more sustainable dynamics, IHS believes.